2021 was a significant year for cryptocurrencies, as the global population recorded increased usage of digital currencies. It is, therefore, not a surprise that the amount of Bitcoin held by private and public companies surged.

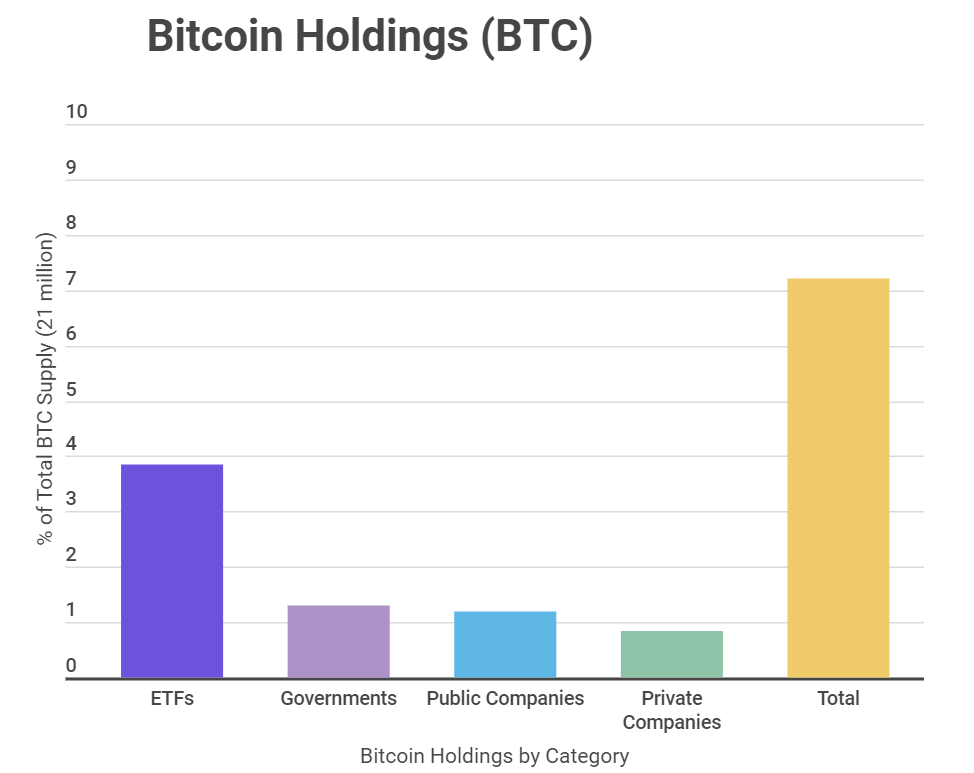

Tradingplatforms.com recently presented data on the amount of Bitcoin held in different categories. According to the findings, Bitcoin treasuries now account for 7.2% of the total Bitcoins supply cap. ETFs account for most of this amount, while private companies hold the least.

Edith Reads from Tradingplatforms.com was asked to comment on the findings, and this is what she said, “There has definitely been a surge in the number of companies adding BTC to their list of assets. Many public companies are using this strategy to hedge against inflation and access BTC exposure on equity markets. Also, ETFs remain popular among BTC buyers, perhaps because they allow for diversification. I think it’s safe to expect increased holdings across the board in the coming months.”

ETfs, governments, and companies hold BTC

Bitcoin holdings across the different categories increased significantly last year as more people came on board. More private and public companies moved to increase their BTC holdings, following the impressive year digital currencies had. More than 40 companies now include BTC in their balance sheets, according to the data reviewed.

BTC holdings spread over ETFs, different countries, public and private companies. ETFs currently hold 3.58%, which is about 809,848 bitcoins. Countries and public companies have 1.292% and 1.181%, respectively. Private companies hold about 174,068 BTC, which is only 0.829%

More countries also got on board the crypto wave, a significant move towards crypto mass adoption. The country with the largest holding is Bulgaria, whose holding accounts for 1.017% of the total supply. El Salvador, which became the first country to make Bitcoin an official currency, comes third with 9500 BTC, about 0.045% Other countries on the list are Ukraine, Finland, and Georgia.

MicroStrategy tops the list of holdings by public companies, while Block.One comes first among private companies. The two hold about 0.592% and 0.667%, respectively. The ETF with the largest holding is Grayscale Bitcoin Trust. The company’s 648.069 bitcoins make up 3.068% of the total coin supply.

MicroStrategy’s conference triggered surge

In February 2021, MicroStrategy held the Bitcoin for Corporations Global Conference. The event aimed to educate companies on all the legal considerations they needed to incorporate BTC in their business operations.

Since the online seminar, there has been a noticeable increase in companies seeking bitcoin ownership.

MicroStrategy is an American business intelligence firm intent on acquiring bitcoin assets. The publicly-traded company currently holds 124,391 BTC, whose value is around $6 billion. Company CEO Michael Saylor is very bullish on BTC and has been making major purchases over the last year.