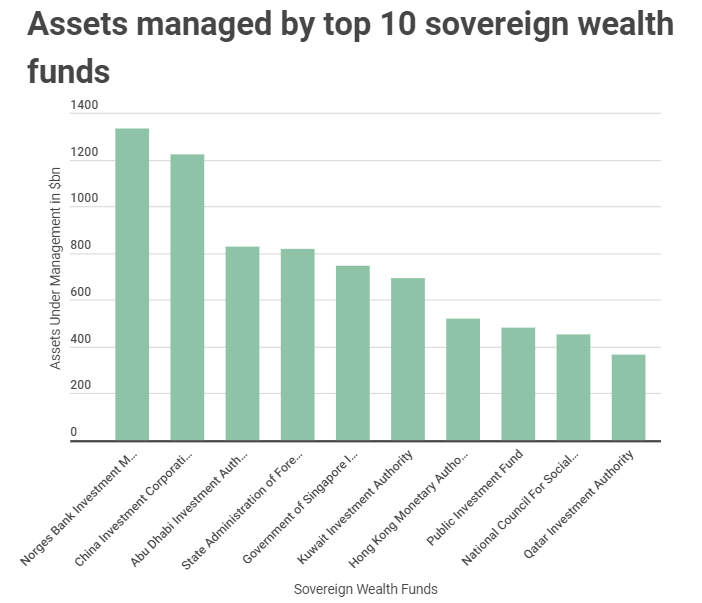

As of January 2022, the world’s top 10 largest sovereign wealth funds (SWFs) manage assets worth $7.4 trillion. The world’s largest SWF, Norges Bank Investment Management (NBIM), handles assets worth $$1.33 trillion. According to the data presented by Financepr.com, the Norwegian Central Bank comes right ahead of China Investment Corporation, whose assets under management total $1.222 trillion.

The two sovereign wealth funds (SWFs) are the only ones whose assets surpass the $1 trillion mark. Other SWFs that made it to the list of the largest funds include the Abu Dhabi Investment Authority, State Administration of Foreign (China), and Government of Singapore Investment Corporation. The three funds hold assets worth $829 bn, $817 bn, and $744 bn, respectively.

Commenting on the findings, Edith Reads from financepr.com had this to say, “The last few years have seen an increase in the assets managed by sovereign funds. More SWfs keep coming up by the day, and we can expect the global total managed assets to also increase. What’s interesting, however, is the recent trend of these SWfs putting their money in alternative investments, such as real estate, infrastructure, private equity and hedge funds.”

Middle East countries more open to alternative investments

Even as more SWFs explore investments outside equity, the NBIM fund seems rooted in its ways. Of the $1.33B worth of assets under management, the fund only allocates 3% of this to alternative investments. As of 2021, the fund’s assets spread over equity, fixed income, real estate, and renewable energy infrastructure, with the first two taking the biggest shares.

Still, some SWFs seem keener to include these alternative investments in their portfolios. Saudi Arabia’s National Development fund allocates its asset funds to alternative assets. The fund ranks 18th on the list of the largest SWFs, with $93 billion assets under management. Another fund, The Public Investment Fund (PIF), manages assets worth $480 bn and allocates 56% of this to alternative investments.

The United Arab Emirates also seems open to the option of alternative investments. Four of the country’s SWFs appear on the top 20 largest funds list; Abu Dhabi Investment Authority (ADIA), The Investment Corporation of Dubai, Mubadala Investment Company, and ADQ. The funds allocate 25%, 65%, 48%, and 58%, respectively to alternative investments.

Sovereign wealth funds stabilize countries’ economies

SWFs have been around since the ’50s, following the formation of the Kuwait Investment Office in 1953. These funds allow nations to channel their capital into different investments that accrue profits and help stabilize the economy through asset diversification in bonds, equities, and other investments.

That said, countries may have different reasons for opening SWFs. Countries with surplus funds, for example, may opt for an SWF to hedge the funds against inflation.