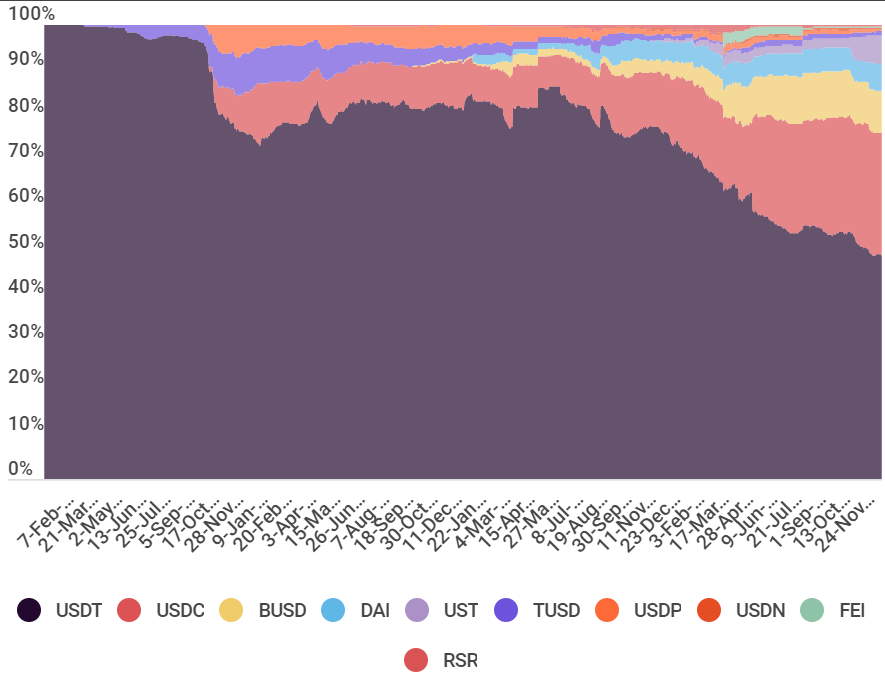

The Tether (USDT) stablecoin is rapidly losing market share. That’s according to data presented by FinancePR.com. The data shows that USDT ceded 51 percent of its share in four years.

According to financepr.com’s Edith Reads, “Tether has shed over 50 percent of its 2018 market share to date. You could attribute that to the entry of other stablecoins jostling with it for market share. These have resonated well with a considerable segment of what used to be USDTs customer base.”

This information is contained in a study that compared the market dominance of the top 10 stable coins over the last 4 years.

Declining USDT dominance

Financepr.com’s presented stats put USDT at a market share of 100 percent in January 2018. But that has since declined to about 49 percent. USDT held a market cap of $78 billion on December 31, 2021.

USD Coin (USDC) commands the second-largest share of the market. The crypto asset added $43 billion or roughly 27 percent of the stable coin’s market.

The Binance USD (BUSD) crypto followed closely at the third spot. This USD backed coin had a cap of roughly $14 billion then. That figure accounted for about 9 percent of the stablecoin market.

Then came TerraUSD (UST), which injected $10 billion into the space, commanding a 6 percent market share.

Additionally, MakerDao added some $9 billion DAI to the stablecoins market. As such, it accounted for roughly some 6 percent.

Further, True USD (TUSD) and Paxos’ USDP digital assets were placed sixth and seventh, respectively. While the former had a cap of $1.3 billion, the latter stood at $946 million. Therefore the two had a combined market share of 1.4%.

Neutrino (USDN), Fei USD (FEI), and Reserve Rights (RSR) closed the top ten in that order. Whereas USDN supplied digital assets worth $532 million, FEI and RSR provided $419 million and $381 million, respectively.

Why is the USDT market share shrinking?

Two reasons explain USDT’s shrinking market share. The first is that there’s been an increase in other stablecoins targeting the same crypto market. These have established themselves as USDT’s alternatives. And as they curve a piece of the market for themselves, they’ve eaten into USDT’s turf.

Secondly, USDT suffered from the Chinese crypto purge. Until then, China was the crypto’s largest market. It was a popular on-ramping tool to crypto markets via OTC brokers. That’s because it’s illegal to buy cryptos using the Yuan.

This continued prohibition of crypto trading activity stifled the asset’s supply in China. One theory that may explain this turn of events is that Chinese USDT holders redeemed their holdings. Thus a significant chunk of the asset returned to Tether’s treasury.

About USDT

USDT is a security-backed cryptocurrency that pegs its value on the U.S. dollar. It’s a product of a Hong Kong firm, Tether, and it debuted in 2014 as Realcoin before rebranding first to U.S. Tether. Another rebrand saw it adopt its current moniker.

The digital asset achieves its stability in different ways. The first is by maintaining a sum of commercial paper. Other means involve treasury bills, cash, and fiduciary deposits. The backing assets in USD terms equal the amount of USDT in circulation.